Division of Unemployment Insurance

Recalculation of Calendar Year 2024 Tax Rates

Due to an administrative reinterpretation of Labor & Employment Article § 8-606(d), the Maryland Division of Unemployment Insurance has recalculated the Annual Tax Rate for Calendar Year 2024 for all earned and standard rate employers. As in calendar years 2022 and 2023, the Division of Unemployment Insurance has compared two different methods of computing the tax rate (one based on pre-pandemic experience and one based on immediate past years’ experience) and assigned the lower of the two rates to each earned and standard rate employer.

The vast majority of employers are not affected by this recalculation. No employer should see a rate increase by this recalculation. All employers’ rates are either unchanged or lowered from the rate provided in the original 2024 Tax Rate Notice sent in January. (New employers do not have the necessary years of history to use the alternate computation method as they do not have pre-pandemic experience.)

If you are an employer affected by the recalculation, your new UI tax rate will appear in your BEACON employer portal Wednesday, March 27th. All employers will receive a new 2024 Rate Notice in their BEACON portal by Monday, April 1, and notice of the correspondence will be sent to each employer in accordance with their preferred method of communication (texts and emails alerting employers of the correspondence will be sent when the correspondence is available on the BEACON portal, while hard copy letters will be mailed Monday, April 1). The correspondence will explain the recalculation and provide other information, including the right to dispute or appeal the rate.

If you have already paid your contributions for Quarter 1 of 2024 and your rate was lowered by the recalculation, you will receive a credit for the difference that can be used towards a future payment. The correspondence will provide further details about how to request a refund instead of receiving credit for future payment.

More information about this recalculation is available on the Recalculation of Calendar Year 2024 Tax Rates FAQs webpage.

Recalculation of Calendar Year 2024 Tax Rates Powerpoint Presentation.

Information for New Claimants

If you are a claimant (an individual who files a claim for unemployment insurance benefits) who is new to the unemployment insurance process, visit the Information for New Claimants webpage

Information for New Employers

If you are an employer who is new to the unemployment insurance (UI) process, visit the Information for New Employers webpage.

Contact Information

The Maryland Division of Unemployment Insurance (the Division) offers several ways claimants, employers, and third-party agents can contact us. See the list below for our primary contact methods.

Please be assured that Maryland does not have a waiting week for UI claims, like many other states do. Claims are effective the week in which they are filed.

Important Contact Information and Links

Online BEACON UI System

You can complete several unemployment insurance tasks, including filing an initial claim, in our online BEACON system, which is available online 24/7.

To learn more, see the BEACON Claimant FAQs and the Unemployment Modernization (BEACON) for Employers and Third-Party Agents webpage.

Claimant Phone Number and Hours of Operation

- To contact a claim agent to file a new claim or inquire about an existing claim, please call 667-207-6520. Claim agents are available from 8:00 a.m. to 4:00 p.m., Monday through Friday. Hours may be modified during holidays.

- If you call during business hours, you may provide a callback number. When an agent becomes available, the system will call the number and connect you with an agent.

Employer and Third-Party Agent Phone Number and Hours of Operation

- The Employer Call Center can be reached at 410-949-0033. Call center hours are 8:00 a.m. to 4:00 p.m., Monday through Friday. Hours may be modified during holidays.

- If you need help activating your employer or agent account in BEACON, please contact the Account Activation Hotline at 410-767-8997.

Automated IVR Phone System

- To connect with the Interactive Voice Response (IVR) system available 24/7, call 410-949-0022 or 1-800-827-4839, toll free. Please listen carefully as many prompts have changed.

- Using the IVR system, claimants can file weekly claim certifications by phone. Claimants can also reset their PIN number, check their payment status, receive filing instructions, and more without having to connect with a claims agent.

Virtual Assistant and Live Chat

You can use the Virtual Assistant to receive immediate, automated answers to common inquiries or to chat with a claims agent. The Virtual Assistant is available 24/7. However, the chat feature is available during claims agent hours (see the Claimant Contact Information webpage for agent hours).

To use the Virtual Assistant, select the “Chat with us” button at the bottom right corner of this page. To use the chat feature, access the Virtual Assistant and type "speak with an agent.”

VRI, VRS, and Maryland Relay

Individuals with certain disabilities (Deafness, Deafblindness, hearing loss, difficulty speaking, limited mobility, or cognitive difficulty) may communicate with the Maryland Department of Labor, Division of Unemployment Insurance (the Division) via scheduled VRI services, Video Relay Services (VRS), Maryland Relay, and other forms of effective communication.

Maryland Relay allows individuals with certain disabilities (listed above) to communicate using a standard telephone. For Maryland Relay, dial 711. Please provide the Maryland Relay operator with the following phone number to reach the Division: 1-667-401-4647.

See the Special Accommodation Information and Resources webpage or the Maryland Relay FAQs to learn more.

Ombudsman Inquiry Form

To submit an inquiry and reach the UI Ombudsman, please fill out the Ombudsman Inquiry Form and e-mail it to ui.ombudsman@maryland.gov

Virtual Kiosk Services by Appointment

The Maryland Division of Unemployment Insurance is offering limited virtual kiosk appointments to take claimant questions about their unemployment insurance claims. Please call a claims agent at 667-207-6520 (Monday to Friday, 8:00 a.m. to 4:00 p.m.) to schedule an appointment.

Please ensure that at the time of your appointment, you are in a location where you will not be interrupted and that you have access to your BEACON portal.

Child Support Withholdings from UI Benefits Email

For inquiries about child support withholdings from your UI benefits or adjustments to these withholdings, email ui.childsupportassistance@maryland.gov.

NOTE: This email address should only be used to inquire about child support withholdings from your UI benefits, and any necessary adjustments.

For questions about child support obligations that are not related to your UI benefits, call the Maryland Department of Human Services (DHS) Child Support Administration at 1-800-332-6347.

**IMPORTANT WARNING**

The Maryland Department of Labor (MD DOL) Benefit Payment Control (BPC) Fraud Unit, or any other unit, will never ask for your BEACON username, password, or banking information through an email or a text message.

All Maryland Department of Labor (MD DOL) email addresses end in .gov. If you receive an email from Ui.fraud@maryland.dol.info and/or from “Maryland BPC Fraud Unit”, please delete it and mark it as Spam.

If you receive an email or text asking for your username, password, banking details, or knowledge-based questions that only you would know the answer to, NEVER respond or open any attachments it contains. You should NEVER provide your details through any website linked in the email or text. Your username and password are for your use only.

If you receive a questionable email or text and have questions, contact MD DOL at 667-207-6520.

Assessment Notice and Pending Civil Action Letters Reinstated

The Maryland Division of Unemployment Insurance (Division) has reinstated the process of mailing the Assessment Notice and Pending Civil Action letters. These letters are sent to employers who were previously informed that they owe payments.

The Division mails at least one delinquency letter to an employer before sending the Assessment Notice and Pending Civil Action letter. Please note that the Division seeks to assist employers in paying quarterly unemployment insurance taxes.

- The Division offers payment plan options. See the Maryland's Unemployment Insurance Payment Plans webpage to learn more.

- Employers are encouraged to request interest and penalty waivers after filing the reports and paying applicable contributions or opting into a payment plan.

- Additional information about this process, including a video and Frequently Asked Questions, are available on our website.

If you have any questions regarding this matter, please contact the Maryland Unemployment Insurance Contributions Division at 410-949-0033 or toll free 1-800-492-5524.

New Power of Attorney Form and Process

The Division instituted a new Power of Attorney (POA) form and authorization process. Due to this change, employers are now required to include the following on the POA form:

- Third Party-Administrator/Agent (TPA) Unemployment Insurance ID number.

- Communication preference for each power that is being granted to the TPA.

Please note that approving a POA designation for a TPA takes up to seven business days. No access will be granted to the TPA before the approval. Once approval is granted, the TPA will receive access to perform the requested functions.

To access the form, see the Power of Attorney Authorization Instructions and Form on the Flyers, Forms, and Publications for Employers & Third Party Agents webpage.

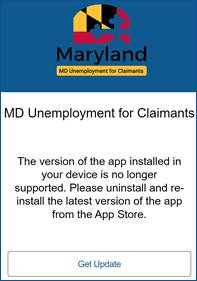

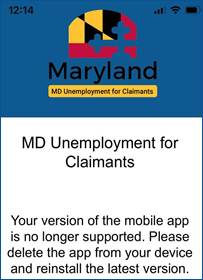

Important Unemployment Mobile App Update!

The Maryland Division of Unemployment Insurance (the Division) updated the MD Unemployment for Claimants mobile app last year (March 8, 2023).

To accommodate this update, the Division released a new version of the app, which you can download from the Google Play Store and the iOS App Store.

If you previously downloaded the app, you must update it for the app to operate properly.

- If you set up automatic updates for the app, it should have updated without any action on your part.

- If you did not set up automatic updates for the app, you will be prompted to begin the update when you see one of the following error messages:

- App Not Supported Error - This error message includes a Get Update button, which you should select to begin the update process. After selecting the button, you will be redirected to either the Google Play Store or the iOS App Store to update the app.

- SSL Not Matching Error - If you see this error message, you should go to the Google Play Store or iOS App Store to update the app.

- App Not Supported Error - This error message includes a Get Update button, which you should select to begin the update process. After selecting the button, you will be redirected to either the Google Play Store or the iOS App Store to update the app.

BEACON System

Overview

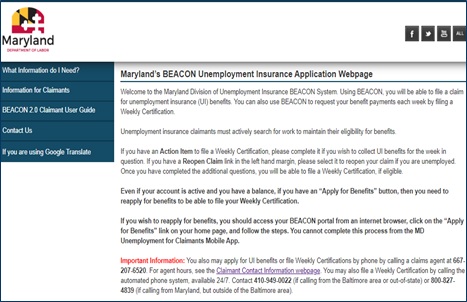

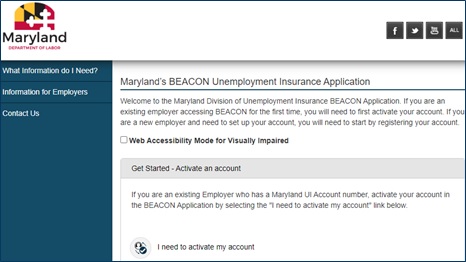

The BEACON unemployment insurance (UI) system launched in September 2020 for claimants, employers, and third party agents. BEACON integrates all benefits, appeals, and tax functions of the UI system.

Download the Claimant and Employer Mobile Apps

In addition to the online BEACON system, the Maryland Division of Unemployment Insurance created two BEACON mobile apps: MD Unemployment for Claimants; and MD Unemployment for Employers.

BEACON Mobile App for Claimants

MD Unemployment for Claimants is available to download for free from the iOS App Store or Google Play Store. The mobile app allows claimants to easily file their weekly claim certifications, view and update claimant information, and more directly from their mobile device.

BEACON Mobile App for Employers

MD Unemployment for Employers is available to download for free from the iOS App Store and the Google Play Store. Registered employers can use the mobile app to make contribution payments, submit wage reports, file appeals, and more directly from their mobile device.

![]()

![]()

Features

The BEACON system offers dozens of features for our stakeholders. Check out the functionalities and features below:

Features for Claimants

Claimants can:

- Access their unemployment insurance claim 24 hours per day/7 days per week

- File initial claims for all program types:

- Regular UI

- Unemployment Compensation for Federal Employees (UCFE)

- Unemployment Compensation for Ex-Servicemembers (UCX)

- Combined Wage Claim (CWC) - Maryland and Out-of-State Claim

- Extended Benefits (EB)

- Work Sharing

- File weekly claim certifications

- Update account details

- name

- address

- Update requests for tax withholding

- Review benefit payment history

- Receive immediate updates regarding their claim status, including up-to-date information about their eligibility

- Retrieve correspondence and other claimant information

- Review benefit payment history

- Respond to fact-finding requests (as required) for additional information

- Submit supporting documents for adjudication or appeals

- File appeals

- Track and pay overpayments

- Maintain their portal account

Features for Employers

Employers can:

- Submit required reports and information

- Update their account information such as address, contact, and ownership

- Access their tax rate and other UI-related information

- Submit wage reports and pay contributions

- Submit adjustments to previously filed wage reports

- Respond to Requests for Separation Information

- File an appeal

- Submit supporting documents for appeals or adjudication

- View all correspondence generated by the system

- Set up an agent to manage their account

Features for Third Party Agents

Agents can:

- Submit a power of attorney online and access their customer’s account based on their privileges granted by the power of attorney

- File wage reports on behalf of their clients

- Make contribution payments on behalf of their clients

- File appeals on behalf of their clients

- Obtain rate information for their clients

BEACON Resources

- BEACON Claimant Tutorial Videos

- BEACON Claimant FAQs

- BEACON Claimant Portal User Guide

- BEACON Glossary of Terms

- BEACON Employers and Third Party Agents Tutorial Videos

- BEACON Employer FAQs

- Employer and Third Party Agent Instructions for Submitting Files in BEACON

Need Help?

Claimants who have questions regarding BEACON should call a claims agent at 667-207-6520. Employers or third party agents who have questions should call the Employer Call Center at 410-949-0033.

Work Search Requirements

Claimants must meet several requirements to be eligible for UI benefits, including work search requirements.

To meet Maryland’s work search requirements, a claimant must:

- register in the Maryland Workforce Exchange (MWE) system;

- upload or create a résumé in MWE, make the résumé viewable to employers, and maintain an up-to-date résumé while collecting UI benefits;

- After you complete your MWE registration, check your MWE inbox frequently for information about weekly tasks or actions that you are required to complete. Failure to complete these activities may result in a delay or denial of your UI benefits

- complete at least three valid reemployment activities each week, which must include at least one job contact; and,

- keep a detailed weekly record of all completed job contacts and valid reemployment activities. Claimants are strongly urged to use the Job Contact and Reemployment Activity Log, located in MWE, to keep this record.

Detailed instructions for completing the requirements listed above are available on the Maryland Work Search Requirements webpage. For work search exemptions, see the Work Search FAQs.

NOTE: The work search requirement was temporarily suspended during the COVID-19 pandemic. In July 2021, the work search requirements were reinstated.

For additional information, see the:

- Work Search FAQs;

- Maryland's Valid Reemployment Activities list; and,

- Job Contact and Reemployment Activity Log video tutorial .

Information about additional claimant requirements is available in the Eligibility Requirements FAQs.

Fraudulent Unemployment Insurance Activity

Report Fraud

If you believe that your information has been used to fraudulently file an unemployment insurance (UI) claim, please complete a Request for Investigation of Unemployment Insurance Fraud form and return it: by email to ui.fraud@maryland.gov; mail to Benefit Payment Control, Room 206, 1100 North Eutaw Street, Baltimore, MD 21201; or fax to 410-767-2610.

If you received a 1099-G tax form, but did not receive UI benefits in Maryland during the prior calendar year:

- complete this Affidavit form and submit it, along with picture ID to dlui1099-labor@maryland.gov.

If you are an employer and believe a fraudulent claim has been charged to your account, please file a benefit charge protest through your BEACON employer portal.

For detailed information about UI fraud in Maryland and protecting yourself from UI fraud scams, see the UI Fraud Awareness and Reporting Instructions webpage.

Identity Theft Resources

If you believe you have been a victim of identity theft, please read the Identity Theft Protection Quick Guide. For more information see the Commissioner of Financial Regulation identity theft page, and the Maryland Department of Labor and Maryland State Police information.

Additional State Resources

If you are in need of additional assistance:

- Office of the Commissioner of Financial Regulation provides information about mortgage relief, foreclosure prevention, and student loan relief programs, as well as other consumer resources.

- Maryland Department of Human Services (DHS) provides cash and food purchasing support, as well as counseling and other services.

- Find out what DHS services may be available for you by completing an initial application online or by contacting the DHS 24-hour helpline hotline at 1-800-332-6347.

NOTE: To reach DHS Child Support Administration, call the DHS hotline (1-800-332-6347). For more, see the Child Support Administration webpage.

For additional resources from the state departments of Labor, Human Resources, and Housing and Community Development, please visit the State of Maryland Financial Resources & Services.

Quick Links

- Assistance from the MD Dept. of Human Resources

- Financial Help with the Cost of Health Coverage

- Find a Job in Maryland

- Information about Tax Benefits and FREE Tax Preparation

- Job Dislocation: Making Smart Financial Choices after a Job Loss

- El desempleo y sus finanzas: Cómo tomar decisiones inteligentes al perder su empleo

- Employers: Pay Federal UI Taxes Online

- Maryland Unemployment Insurance Complaints